Last month Molly Moore, Health Plan Lead at Decent, joined Freelance Austin to help us understand the confusing world of health insurance. With Open Enrollment for 2020 running from November 1st to December 15th, 2019, it’s not too late to get coverage. Thanks to Molly, we freelancers are now better educated on how to choose a plan that’s right for us. Read on for tips from Molly’s talk, Health Insurance Shopping Tips For Freelancers.

First and foremost, shop for your personal needs.

Your first step should be identifying your priorities. The following questions will help you figure out exactly what you need in a healthcare plan.

Do You Qualify for Subsidies?

Your estimated earnings may qualify you for subsidies to help with your healthcare costs. The following links will help you determine whether or not you could qualify for a subsidy.

Begin your search for answers about subsidies at this link.

Click here to figure out how to estimate your income.

1. What’s Your Budget?

When you’re trying to figure out your Healthcare budget, there are two ways to look at it.

When thinking about how much coverage you’ll need, you may choose to pay a low monthly premium with a high out-of-pocket. This coverage is a cost saver as long as you don’t need a lot of medical intervention.

Alternatively, if you are able to determine your health care needs for the next year, you’ll want to budget for what you know you’re going to have to pay, plus one ER visit and your monthly premium.

If you know what you’re likely going to need, you’ll be able to budget for your true needs and find a plan that meets those needs.

2. Do You Take Any Medications?

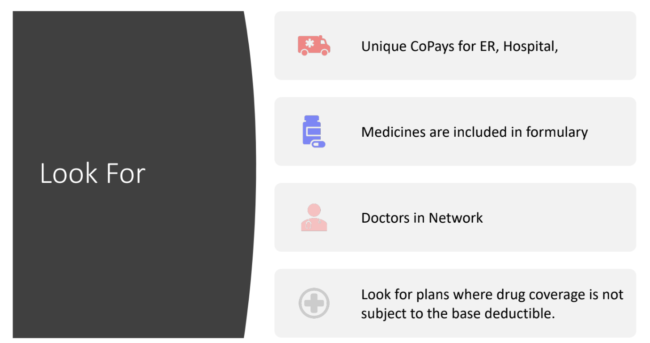

Make sure your medicines are covered in the plan you choose. Some plans don’t cover all the drugs that you need to stay healthy.

3. How Much Do You Love Your Doctor?

You may love your doctor, but the insurance plan that you’re looking at may not cover care provided by that doctor. Insurance companies negotiate lower rates with doctors, specialists, and hospitals. When you stay in-network, you save money with these pre-negotiated rates. If you really want to keep a particular doctor, you’ll need to find out which plans your doctor works with.

4. Do You Need Family Planning?

Plans vary regarding what they’ll cover for your inpatient stay when you have a baby. They also vary in prenatal care coverage.

Ready to Shop?

Your first stop should be healthcare.gov. This is especially true if you qualify for subsidies.

You may also consider using an insurance broker. Brokers are generally free for you but are paid by the insurance companies. The article linked here gives you more information about how insurance brokers work, and how they are paid.

What are your market options?

Commercial Insurance — the most common.

Commercial Insurance is what most people think of when they think of getting Healthcare coverage. It provides the most comprehensive coverage.

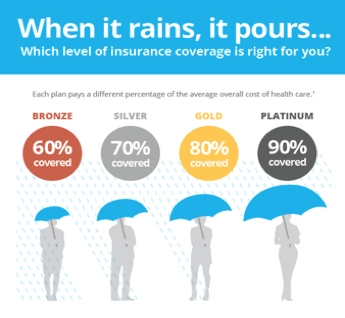

What you’ll pay out-of-pocket versus what the insurance company will cover depends on which level of Commercial Insurance you choose. The graphic below gives a general overview of the amount of coverage for each level of commercial insurance plans.

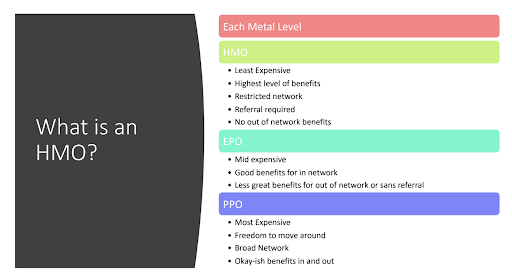

Each level of insurance coverage has even more options. The graphic below contains an overview of the differences between HMOs, EPOs and PPOs.

Short Term Medical — when you’re pretty healthy.

Short-term insurance policies provide coverage for a specific period of time, usually 12 months. This option is cheaper than commercial insurance, but it is also more likely to deny coverage or charge you more based on things like age, gender, and medical history.

Health Sharing Ministries — share the risk, wait to get paid.

With health sharing ministries, you pay into a pool. These health care plans are not obliged to cover you. They usually reimburse you for costs paid, and it can take a long time to get reimbursed.

Catastrophic Plan — if you just don’t want to go bankrupt.

Catastrophic health care plans basically just keep you from bankruptcy. This type of plan generally pays nothing until you’ve spent between $20,000 and $35,000 out of pocket.

There you have it, the basics of health insurance shopping. As a WCA and Freelance Austin sponsor, Decent is offering a special discount on health insurance premiums to our current registered members, so be sure to check out what they have to offer.

Want further education on the health insurance market?

Follow Decent on LinkedIn. They share helpful articles on their company page. Nick Soman, Decent’s Founder and CEO, has been sharing videos of Molly explaining healthcare in his newsfeed. If you missed Molly’s talk, you can still catch her warm and wonderful explanations there.

- Event Recap: Breaking Up with Freelance Clients (And Why It’s Actually Good for Your Business) - January 16, 2020

- Health Insurance Shopping Tips for Freelancers – Event Recap - December 6, 2019

- Jeanie Garrett’s Leap of Faith into Freelancing - October 23, 2019